Complexity and Obligation: Using an SDIRA, you've got more Handle in excess of your investments, but You furthermore may bear additional duty.

As an Trader, on the other hand, your options are not limited to shares and bonds if you decide on to self-direct your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

No matter whether you’re a fiscal advisor, investment issuer, or other economic Qualified, discover how SDIRAs may become a powerful asset to expand your enterprise and obtain your Skilled objectives.

The tax benefits are what make SDIRAs eye-catching For most. An SDIRA can be both conventional or Roth - the account sort you end up picking will count largely on the investment and tax strategy. Check along with your economic advisor or tax advisor should you’re Not sure which happens to be finest for you personally.

Indeed, real estate is one of our shoppers’ most widely used investments, occasionally referred to as a real-estate IRA. Customers have the option to speculate in all the things from rental Homes, business real-estate, undeveloped land, home loan notes and even more.

Minimal Liquidity: Many of the alternative assets that could be held within an SDIRA, for instance property, personal fairness, or precious metals, might not be quickly liquidated. This may be a problem if you must accessibility funds swiftly.

Greater investment alternatives signifies it is possible to diversify your portfolio beyond stocks, bonds, and mutual cash and hedge your portfolio towards current market fluctuations and volatility.

This incorporates knowing IRS laws, managing investments, and avoiding prohibited transactions that may disqualify your IRA. A scarcity of knowledge could lead to high priced issues.

Ease of Use and Technology: A person-friendly platform with on-line instruments to trace your investments, post files, and deal with your account is essential.

Larger Expenses: SDIRAs normally come with higher administrative expenditures in comparison with other IRAs, as sure elements of the executive process cannot be automated.

Customer Help: Try to find a company that gives dedicated help, which include usage of proficient my explanation specialists who can remedy questions about compliance and IRS principles.

Relocating website link cash from one particular form of account to another kind of account, which include shifting funds from the 401(k) to a conventional IRA.

IRAs held at financial institutions and brokerage firms provide constrained investment alternatives to their consumers because they do not have the know-how or infrastructure to administer alternative assets.

Numerous buyers are surprised to learn that applying retirement funds to invest in alternative assets has been achievable considering that 1974. However, most brokerage firms and banking institutions target providing publicly traded securities, like stocks and bonds, simply because they lack the infrastructure and expertise to deal with privately held assets, including housing or private fairness.

Have the freedom to invest in Practically any type of asset having a threat profile that fits your investment technique; which includes assets that have the possible for a higher charge of return.

Adding income straight to your account. Bear in mind contributions are matter to annual IRA contribution boundaries set because of the IRS.

Criminals at times prey on SDIRA holders; encouraging them to open up accounts for the objective of earning fraudulent investments. They typically idiot traders by telling them that Should the investment is acknowledged by a self-directed IRA custodian, it needs to be genuine, which isn’t legitimate. Once more, You should definitely do thorough due diligence on all investments you choose.

SDIRAs will often be used by hands-on investors who are willing to tackle the challenges and obligations of choosing and vetting their investments. Self directed IRA accounts can be perfect for traders which have specialized understanding in a distinct segment current market which they wish to spend money on.

Be in command of how you improve your retirement portfolio by utilizing your specialized information and interests to take a position in assets that in shape with why not try here the values. Bought expertise in real-estate or personal equity? Use it to help your retirement planning.

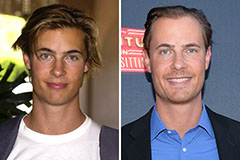

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Erik von Detten Then & Now!

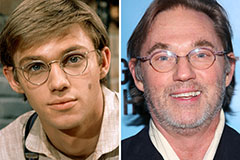

Erik von Detten Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Christy Canyon Then & Now!

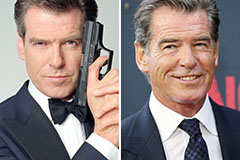

Christy Canyon Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!